Health Insurance Benefits

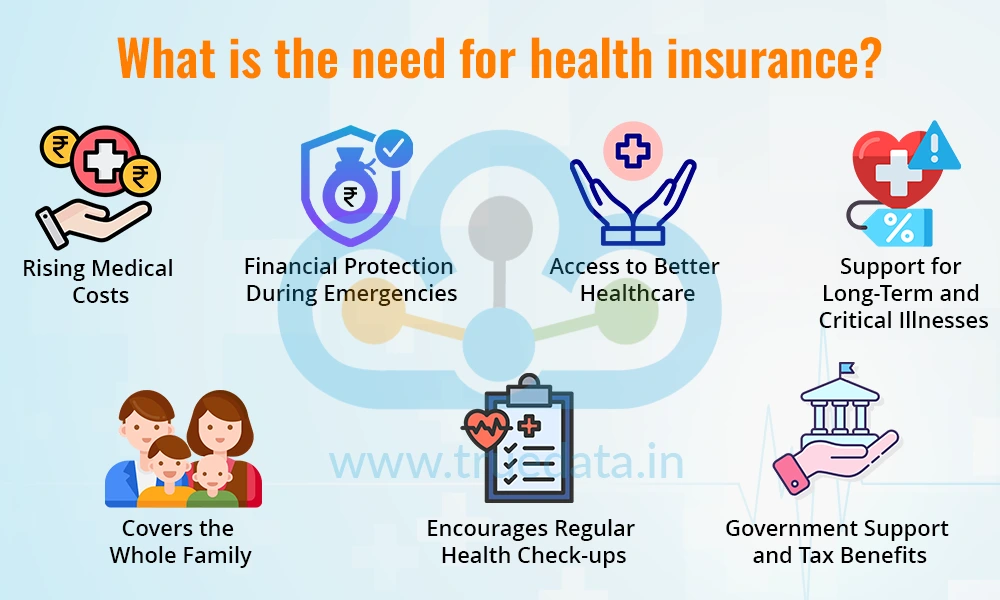

Health Insurance Benefits: Health insurance plays a critical role in modern healthcare systems by bridging the gap between rising medical costs and an individual’s ability to afford quality treatment. As medical technology advances and healthcare standards improve, treatment expenses continue to rise steadily. Without adequate coverage, even a short hospital stay can significantly disrupt personal savings and long-term financial plans. Health insurance addresses this challenge by offering structured financial protection, access to healthcare services, and long-term stability for individuals and families.

This detailed guide explores health insurance benefits in depth, explaining how it supports physical health, financial security, and overall well-being across different stages of life.

The Fundamental Purpose of Health Insurance

Risk Management and Cost Sharing

At its core, health insurance is a risk management tool. It spreads the financial risk of medical expenses across a large pool of policyholders. Instead of one individual paying the full cost of treatment, the insurer absorbs a major portion of the expense. This system makes healthcare more affordable and predictable, even in cases of serious illness or medical emergencies.

By paying a relatively small premium at regular intervals, policyholders gain protection against potentially catastrophic healthcare costs. This approach ensures stability and safeguards individuals from sudden financial shocks.

Financial Security Through Health Insurance

Coverage for Unexpected Medical Emergencies

Medical emergencies are unpredictable and often expensive. Accidents, sudden illnesses, or emergency surgeries can occur without warning. Health insurance ensures that such events do not result in overwhelming financial stress. Expenses related to emergency care, hospitalization, surgeries, and intensive care are typically covered, subject to policy terms.

This financial support allows patients and families to focus on treatment and recovery rather than arranging funds during critical moments.

Reduction in Out-of-Pocket Expenses

Without insurance, individuals must pay medical bills directly from their savings. Health insurance significantly reduces out-of-pocket expenses by covering a large percentage of medical costs. Even when deductibles or co-payments apply, the overall financial burden is far lower than paying the full amount independently.

Hospitalization and Treatment Coverage

Inpatient Hospitalization Benefits

Most health insurance plans provide comprehensive coverage for inpatient hospitalization. This includes expenses such as room charges, nursing services, medical procedures, operation theater fees, and specialist consultations. These benefits ensure that patients receive necessary care without compromising on treatment quality.

Some policies also offer flexible room rent options, enabling policyholders to choose better facilities based on comfort and medical needs.

Pre-Hospitalization and Post-Hospitalization Care

Health insurance extends beyond hospital admission and discharge. Pre-hospitalization coverage includes diagnostic tests, medical consultations, and evaluations required before admission. Post-hospitalization coverage supports follow-up visits, medications, and rehabilitation services for a specified period after discharge.

This continuity of care is essential for complete recovery and helps prevent complications that may arise after treatment.

Cashless Treatment and Network Hospitals

Ease of Access During Medical Emergencies

Cashless treatment is one of the most practical benefits of health insurance. When policyholders receive treatment at network hospitals, the insurer directly settles the medical bills with the healthcare provider. This eliminates the need for upfront payments, which can be difficult to arrange during emergencies.

Cashless facilities simplify the treatment process and reduce administrative stress for patients and their families.

Wide Network of Healthcare Providers

Insurance companies maintain extensive networks of hospitals, clinics, and diagnostic centers. This ensures that policyholders have access to quality healthcare services across different locations, enhancing convenience and accessibility.

Preventive Healthcare and Wellness Benefits

Regular Health Check-Ups

Preventive care is a key component of modern health insurance. Many policies include periodic health check-ups at no additional cost. These screenings help detect health conditions at an early stage, when treatment is more effective and less expensive.

Early diagnosis not only improves health outcomes but also reduces the long-term financial impact of chronic diseases.

Wellness and Lifestyle Management Programs

Some insurers offer wellness benefits that encourage healthy living. These may include fitness tracking, nutrition guidance, stress management programs, and rewards for maintaining healthy habits. Such initiatives promote long-term well-being and reduce the likelihood of future medical claims.

Coverage for Critical and Chronic Illnesses

Support for High-Cost Treatments

Critical illnesses often require prolonged treatment and specialized care. Health insurance policies may include coverage for conditions such as cancer, heart disease, stroke, and organ failure. This coverage helps manage the high costs associated with advanced medical treatments and long-term care.

Some plans provide a lump-sum benefit upon diagnosis, offering financial flexibility to cover treatment expenses, travel, or loss of income.

Management of Chronic Conditions

Chronic illnesses such as diabetes, asthma, and hypertension require ongoing medical attention. Health insurance supports regular consultations, diagnostic tests, and medications, ensuring consistent care and better disease management.

Maternity and Childcare Benefits

Maternity Coverage

Maternity benefits are an important feature for families planning to expand. These benefits typically cover prenatal care, delivery expenses, and postnatal treatment. Given the high cost of maternity care, insurance coverage provides financial relief during pregnancy and childbirth.

Newborn and Child Healthcare

Many policies extend coverage to newborns, including vaccinations and early medical care. This ensures that children receive timely healthcare support from the earliest stages of life.

Mental Health and Emotional Well-Being

Comprehensive Mental Health Coverage

Mental health is increasingly recognized as an integral part of overall health. Health insurance plans now often include coverage for mental health conditions such as anxiety, depression, and stress-related disorders. Coverage may include therapy sessions, psychiatric consultations, and prescribed medications.

By supporting mental health care, insurance promotes a balanced approach to physical and emotional well-being.

Tax Advantages of Health Insurance

Tax Savings and Financial Efficiency

Health insurance premiums often qualify for tax deductions under applicable tax laws. These deductions reduce taxable income, resulting in immediate financial savings. Additional tax benefits may apply for insuring family members, especially senior citizens.

Tax advantages enhance the overall value of health insurance, making it a financially efficient investment.

Family and Senior Citizen Health Insurance Benefits

Family Floater Plans

Family floater plans provide coverage for multiple family members under a single policy. This structure is cost-effective and flexible, allowing the insured amount to be shared among family members as needed. It simplifies policy management and ensures comprehensive family protection.

Senior Citizen Health Insurance

Senior citizens often face increased medical needs. Specialized plans for seniors offer coverage for age-related illnesses, regular health monitoring, and sometimes home-based care. These benefits provide essential support during retirement years.

Customization Through Add-On Benefits

Riders for Enhanced Coverage

Add-on riders allow policyholders to enhance their base policy. Common riders include critical illness cover, personal accident protection, room rent waiver, and alternative treatment coverage. These options enable customization based on individual health risks and lifestyle needs.

Long-Term Financial Planning and Stability

Preserving Savings and Investments

Health insurance protects personal savings from being depleted by medical expenses. By covering treatment costs, it allows individuals to preserve their investments and maintain financial goals such as education, retirement, or property ownership.

Peace of Mind and Confidence

Knowing that medical expenses are covered provides peace of mind. This confidence enables individuals to make informed healthcare decisions without fear of financial consequences.

Conclusion About Health Insurance Benefits

Health insurance is a cornerstone of responsible financial and healthcare planning. It offers comprehensive protection against medical expenses, promotes preventive care, supports mental and physical health, and provides long-term financial stability. From routine check-ups to critical illness management, health insurance ensures that individuals and families are prepared for both expected and unexpected healthcare needs.

In an environment of rising medical costs and evolving health risks, investing in the right health insurance plan is not just a precaution but a necessity. It empowers individuals to prioritize health without compromising financial security, making it one of the most valuable tools for a stable and confident future.

FAQs About Health Insurance Benefits

Why is health insurance important even for healthy individuals?

Health insurance is important because medical emergencies are unpredictable. Even healthy individuals can face sudden illnesses or accidents that result in high medical costs. Insurance provides financial protection and access to quality care when needed.

What factors should be considered when choosing a health insurance plan?

Key factors include coverage scope, sum insured, network hospitals, waiting periods, exclusions, premium cost, and additional benefits such as preventive care and wellness programs.

Does health insurance cover outpatient treatments?

Some health insurance plans offer limited outpatient coverage, including consultations and diagnostic tests. However, coverage varies by policy, and reviewing terms is essential.

How does health insurance support long-term illness management?

Health insurance covers regular consultations, diagnostic tests, medications, and sometimes rehabilitation services, ensuring consistent care for chronic and long-term conditions.

Can health insurance reduce financial stress during retirement?

Yes, health insurance plays a crucial role during retirement by covering medical expenses, preserving savings, and providing access to necessary healthcare services without financial strain.