FICO Score vs Vantage Score

FICO Score vs Vantage Score: Credit scores play a central role in modern financial life. They influence loan approvals, interest rates, rental applications, insurance premiums, and sometimes even employment decisions. When people check their credit score online, they are often surprised to see different numbers depending on the platform. This confusion usually comes down to one question: FICO Score vs Vantage Score. Both are legitimate credit scoring models, but they are not identical. Understanding how they work, how they differ, and how lenders use them is essential for anyone who wants to manage credit intelligently.

This article provides a detailed, human-written, SEO-friendly explanation of FICO Score and Vantage Score, how each model calculates scores, why scores differ, and which one matters more in real-world lending decisions.

What Credit Scores Really Represent

Credit scores are numerical summaries of creditworthiness based on data in credit reports. They are designed to predict the likelihood that a borrower will repay debt as agreed. Both FICO and Vantage Score analyze the same underlying data from the three major credit bureaus: Equifax, Experian, and Transunion. However, they interpret that data differently.

Credit scores are risk prediction tools, not judgments of character.

They focus on patterns of behavior such as payment consistency, debt usage, and credit history length. Even small changes in behavior can influence scores, sometimes quickly and sometimes over time.

Understanding the scoring model being used helps explain why numbers vary and how to respond strategically.

The Origin of FICO Score

FICO Score was created by the Fair Isaac Corporation in 1989. It was developed to standardize credit risk assessment across lenders. Before FICO, lending decisions were inconsistent and subjective. FICO introduced a data-driven approach that quickly became the industry standard.

FICO Score became dominant because lenders trusted its predictive accuracy.

Over time, banks, mortgage lenders, auto lenders, and credit card issuers built their underwriting systems around FICO models. Today, the vast majority of lending decisions in the United States rely on some version of FICO Score.

FICO has released multiple versions over the years, each refining how risk is measured. This evolution explains why there is not just one FICO score, but many.

The Origin of Vantage Score

Vantage Score was introduced in 2006 as a joint venture by Equifax, Experian, and TransUnion. The goal was to create a more consistent and accessible scoring model across all three bureaus.

Vantage Score was designed to score more consumers.

One of its main objectives was to generate scores for people with limited or new credit histories who were often excluded by older FICO models.

While Vantage Score is newer, it has grown rapidly, especially in consumer-facing credit monitoring tools and free score platforms.

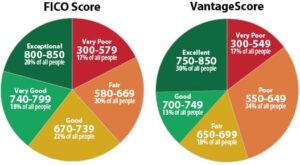

Basic Score Ranges Compared

Both FICO Score and Vantage Score use similar numerical ranges, which contributes to confusion.

FICO Score range typically runs from 300 to 850.

Vantage Score range also runs from 300 to 850 in its latest versions.

Despite identical ranges, the meaning of a specific number can differ slightly between the two models. A 700 FICO score does not always represent the same risk level as a 700 Vantage Score.

Understanding category definitions helps clarify this difference.

Credit Score Categories in Each Model

Credit score categories help lenders quickly assess risk.

FICO Score categories generally break down as poor, fair, good, very good, and excellent.

Each range has specific lending implications, especially for mortgages and auto loans.

Vantage Score categories are similar but not identical.

Vantage Score tends to classify scores slightly differently, particularly in the fair-to-good range.

These subtle differences mean that someone may be considered “good” less than one model and “fair” under another

How FICO Score Calculates Credit Risk

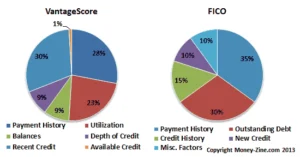

FICO Score uses five main factors, each weighted differently.

Payment history is the most influential factor in FICO scoring.

Late payments, delinquencies, collections, and bankruptcies significantly affect the score.

Amounts owed, especially credit utilization, carry heavy weight.

High balances relative to limits signal increased risk.

Length of credit history rewards older, well-managed accounts.

Longer histories generally improve scores.

Credit mix evaluates different types of credit.

A combination of revolving and installment accounts is viewed positively.

New credit looks at recent inquiries and account openings.

Frequent applications can temporarily lower scores.

This structure emphasizes long-term behavior and stability.

How Vantage Score Calculates Credit Risk

Vantage Score uses similar factors but groups and weighs them differently.

Payment behavior remains extremely influential.

Consistent on-time payments are critical.

Depth of credit considers total experience with credit.

This includes account age and usage patterns.

Credit utilization is highly sensitive in Vantage Score models.

Balances play a strong role in score movement.

Recent credit behavior looks at new activity.

This includes inquiries and newly opened accounts.

Available credit considers unused credit limits.

Higher available credit can support higher scores.

Vantage Score is often more responsive to recent changes than older FICO versions.

Key Differences in Scoring Philosophy

Although both models assess risk, their philosophies differ.

FICO Score prioritizes long-term predictability.

It favors stability and consistency over time.

Vantage Score emphasizes recent behavior and inclusivity.

It aims to score more consumers and respond faster to changes.

This philosophical difference explains why scores may diverge after recent credit activity.

Minimum Credit History Requirements

One of the most important differences lies in eligibility.

FICO typically requires at least six months of credit history.

There must also be recent account activity.

Vantage Score can generate a score with as little as one month of history.

It also requires only one account reported in the past 24 months.

This makes Vantage Score more accessible to beginners and those re-entering the credit system.

How Each Model Treats Late Payments

Late payments impact both models, but timing matters.

FICO heavily penalizes recent late payments.

Severity increases with the length of delinquency.

Vantage Score also penalizes late payments but may show faster recovery.

Recent positive behavior can offset older issues more quickly.

Neither model ignores late payments, but recovery timelines can differ.

How Collections Are Treated Differently

Collections accounts are a major source of score variation.

FICO 8 ignores paid collections only in limited cases.

Unpaid collections significantly lower scores.

Vantage Score 3.0 and later ignore paid collections entirely.

This can result in higher scores after collections are resolved.

This difference explains why consumers often see higher Vantage Scores after paying collections.

How Medical Debt Is Scored

Medical collections are treated more leniently in newer models.

FICO models reduce the impact of medical collections.

Paid medical collections are often ignored.

Vantage Score also minimizes medical debt impact.

Medical collections are weighted less than non-medical ones.

This shift reflects broader industry recognition of medical billing complexities.

Credit Utilization Sensitivity Compared

Credit utilization affects both models, but not identically.

FICO prefers utilization below 30 percent, with optimal results below 10 percent.

Lower utilization consistently improves scores.

Vantage Score is often more sensitive to utilization spikes.

Small balance increases can cause noticeable changes.

This makes Vantage Score appear more volatile month to month.

How Hard Inquiries Affect Each Score

Hard inquiries signal new credit risk.

FICO groups similar inquiries within a short window.

This reduces the impact of rate shopping.

Vantage Score also groups inquiries but may apply different timeframes.

The impact is generally short-lived in both models.

Inquiries typically affect scores for up to 12 months.

Score Updates and Reporting Frequency

Scores update when new data is reported.

FICO and Vantage Score both recalculate scores after each bureau update.

Most lenders report monthly.

Vantage Score may reflect changes slightly faster due to its design, but both rely on reporting cycles.

Why Credit Monitoring Sites Show Vantage Score

Many free credit score websites display Vantage Score.

Vantage Score is cheaper for platforms to license.

This makes it widely used in consumer apps.

FICO is often reserved for lender use.

Some paid services offer FICO access.

This difference leads consumers to track Vantage Score while lenders review FICO.

Which Score Do Lenders Actually Use?

This is the most practical question.

Most mortgage lenders use FICO scores.

Auto and credit card lenders also heavily rely on FICO.

Vantage Score is used by some lenders but far less frequently.

Its adoption is growing, but FICO remains dominant.

Knowing this helps prioritize which score matters most for major financial decisions.

Why Your FICO and Vantage Score Differ

Score differences are normal and expected.

Different weighting systems create different results.

Timing, balance changes, and collections treatment all matter.

Neither score is wrong.

They simply answer the risk question differently.

Understanding this prevents unnecessary stress over score discrepancies.

Which Score Should You Focus On Improving?

The answer depends on your goal.

For mortgages and major loans, FICO Score matters more.

Improving FICO should be the priority.

For general credit monitoring, Vantage Score is still useful.

It tracks trends and alerts changes.

Improving core credit behaviors benefits both models simultaneously.

How to Improve Both FICO and Vantage Score Together

The fundamentals remain the same.

Pay all bills on time without exception.

Keep credit utilization low.

Avoid unnecessary credit applications.

Allow accounts to age naturally.

Monitor reports for errors.

These habits are universally rewarded across scoring models.

Common Myths about FICO and Vantage Score

Many misconceptions cause confusion.

One score is not more “real” than the other.

Checking scores does not hurt credit.

Closing accounts rarely helps scores.

Understanding facts eliminates fear-based decisions.

The Future of Credit Scoring Models

Both models continue to evolve.

FICO releases newer versions to improve predictive accuracy.

Vantage Score focuses on inclusivity and real-time behavior.

As alternative data becomes more common, scoring models may change further, but core principles remain stable.

Conclusion: FICO Score vs. Vantage Score Explained Clearly

FICO Score and Vantage Score are two legitimate but distinct credit scoring models. They use the same credit report data but apply different formulas, priorities, and philosophies. FICO dominates lending decisions, especially for mortgages and major loans, while Vantage Score is widely used for consumer monitoring and accessibility. Understanding how each model works removes confusion, sets realistic expectations, and empowers smarter financial decisions. By focusing on strong credit habits, both scores improve over time, regardless of which model is being viewed.