Budgeting Tips for Beginners

Introduction

Budgeting Tips for Beginners: Budgeting often feels overwhelming for beginners because money is emotional. Many people associate budgeting with restrictions, complex calculations, or the fear of realizing they’ve been “doing everything wrong.” If you’ve ever avoided checking your bank balance or felt stressed at the end of the month, you’re not alone. That discomfort is exactly why budgeting feels hard at first.

The truth is, budgeting does not require special math skills, financial expertise, or a high income. It’s simply a tool to help you understand where your money is going and make intentional decisions. You don’t need to give up everything you enjoy; budgeting is about balance, not punishment.

These budgeting tips for beginners are designed for real life. Whether you’re a student, earning a low income, freelancing, or just trying to get better with money, this guide will walk you through budgeting step by step. By the end, you’ll understand how to create a simple budget, avoid common mistakes, and build habits that improve your finances over time.

What Is Budgeting?

Budgeting is the process of creating a plan for how you earn, spend, and save money. In simple terms, it tells your money where to go instead of wondering where it went. Budgeting helps you make decisions before you spend, which is why it’s so powerful.

At its core, budgeting answers three basic questions:

- How much money do I earn?

- Where does my money go?

- How much can I save?

Budgeting matters because it creates clarity. When you don’t track your money, stress builds from uncertainty. A budget removes that uncertainty. It helps reduce money stress by giving you control, even if your income is small or irregular. You don’t need a perfect budget, just a clear one.

Why Budgeting Is Important for Beginners

Understanding the importance of budgeting early can prevent many financial problems later. For beginners, budgeting builds a strong foundation.

Here’s why it matters:

- Better spending control: You stop overspending without realizing it.

- Less debt: Budgeting helps avoid relying on credit cards or loans.

- Easier saving: Even small savings become consistent when planned.

Real-life example:

A beginner earning a modest income feels unable to save. After tracking expenses, they notice frequent small purchases of snacks, subscriptions, and impulse buys. By adjusting just one habit, they free up money to start an emergency fund. No extra income required, just awareness.

Budgeting turns money from a source of stress into a tool for stability.

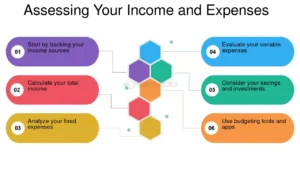

How to Create a Simple Budget

Learning how to create a budget doesn’t have to be complicated. A simple budget is often the most effective.

Calculate Monthly Income

Write down all sources of income after taxes:

- Salary

- Side jobs

- Freelance work

- Allowances or support

If income varies, use an average.

List Fixed Expenses

Fixed expenses are bills that stay mostly the same each month:

- Rent or housing

- Utilities

- Internet and phone

- Insurance

- Loan payments

These expenses come first because they’re non-negotiable.

Track Variable Expenses

Variable expenses change monthly:

- Groceries

- Transportation

- Dining out

- Entertainment

- Personal spending

Track these carefully; they’re where most overspending happens.

Set Savings Goals

Start small. Even 5.10% of your income is enough to begin. Savings goals can include:

- Emergency fund

- Short-term goals

- Future plans

Adjust and Review

Your first budget won’t be perfect, and that’s normal. Review it monthly and adjust as needed.

Simple Budget Example:

| Category | Amount |

| Income | $2,000 |

| Fixed Expenses | $1,100 |

| Variable Expenses | $600 |

| Savings | $300 |

Easy Budgeting Tips for Beginners

These easy budgeting tips make budgeting realistic and sustainable:

- Start small instead of changing everything at once

- Track expenses daily for awareness

- Use cash or budgeting apps to limit overspending

- Avoid impulse buying by waiting 24 hours

- Review your budget weekly

Progress matters more than perfection.

Popular Budgeting Methods for Beginners

Different budgeting methods work for different personalities.

50/30/20 Budget Rule

You spend:

- 50% on needs

- 30% on wants

- 20% on savings

This method is simple and flexible.

Zero-Based Budget

Every dollar has a job. Income minus expenses equals zero. Great for full control and accountability.

Envelope System

Cash is divided into envelopes for spending categories. When the envelope is empty, spending stops.

Common Budgeting Mistakes Beginners Make

Avoid these beginner budgeting mistakes:

- Creating unrealistic budgets

- Forgetting irregular expenses like gifts or repairs

- Not tracking daily spending

- Giving up after one bad month

Mistakes are part of learning. Budgeting improves with consistency.

Best Budgeting Tools & Apps for Beginners

The best budgeting tools for beginners are the ones you’ll actually use:

- Spreadsheets: Customizable and free

- Mobile apps: Automatic tracking and reminders

- Pen & paper: Simple and effective

There’s no “best” tool, only what fits your lifestyle.

Budgeting Tips for Students & Low-Income Earners

Budgeting for students and low-income earners focuses on essentials and habits.

Helpful strategies:

- Prioritize housing, food, and transportation

- Build savings with very small amounts

- Use free budgeting tools

- Avoid lifestyle inflation

Budgeting is often most effective when money is limited.

FAQS About Budgeting Tips for Beginners

How much should beginners save each month?

Start with 5.10% of your income and increase gradually.

How long does it take to get used to budgeting?

Most people adjust within 2 or 3 months.

Can budgeting work with low income?

Yes. Budgeting helps stretch limited income further.

Conclusion About Budgeting Tips for Beginners

Budgeting is not about restriction; it’s about freedom and control. You don’t need to be perfect or make drastic changes overnight. Start today with one small step: track your spending, write down your income, or set a tiny savings goal.

Budgeting improves over time. The more you practice, the easier it becomes. Start now, stay consistent, and explore related guides on saving money, credit score basics, and personal loan basics to continue strengthening your financial future.