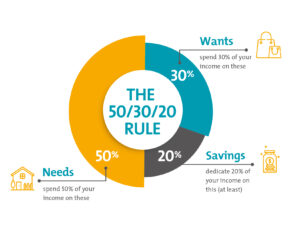

50/30/20 Budget Rule

This budgeting method is specially famous because it’s miles bendy, smooth to bear in mind, and appropriate for humans at specific profits levels. Whether you’re just beginning your profession, assisting a own family, or making plans for lengthy-term dreams, the 50/30/20 rule provides a clean structure for making smarter financial selections.

What Is the 50/30/20 Budget Rule?

The Basic Concept Explained

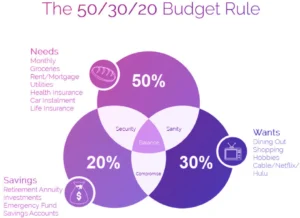

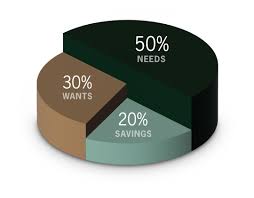

At its core, the 50/30/20 rule suggests that you allocate your monthly after-tax income as follows:

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment

This division ensures that your essential expenses are covered, you still have room to enjoy discretionary spending, and you consistently build financial security.

Why the Rule Is So Effective

The strength of the 50/30/20 rule lies in its simplicity. Instead of tracking dozens of spending categories, you focus on three clear priorities. This makes budgeting less overwhelming and more sustainable in the long run.

Breaking Down the 50% Needs Category

What Counts as Needs

Needs are essential expenses that you must pay to maintain a basic standard of living. These are non-negotiable costs that, if unpaid, could significantly affect your daily life.

Common Examples of Needs

Housing Costs

Rent or mortgage payments typically take up the largest portion of the needs category. Property taxes and basic home insurance also fall under this heading.

Utilities and Basic Services

Electricity, gas, water, garbage collection, and internet required for work or education are considered necessities.

Food and Groceries

Groceries and basic household supplies count as needs. Dining out, however, usually belongs in the wants category.

Transportation

Public transportation fares, fuel, car insurance, and essential maintenance costs are included here.

Health and Insurance

Health insurance premiums, basic medical expenses, and prescription medications are part of your needs because they protect your physical and financial well-being.

Keeping Needs Within 50%

If your needs exceed 50% of your income, it may signal that your cost of living is too high for your earnings. In such cases, you might consider downsizing housing, reducing transportation costs, or finding ways to lower utility bills.

Understanding the 30% Wants Category

Defining Wants

Wants are non-essential expenses that improve your lifestyle but are not necessary for survival. These expenses add comfort, enjoyment, and convenience to your life.

Examples of Wants

Entertainment and Leisure

Streaming subscriptions, movies, concerts, hobbies, and vacations fall into this category.

Dining Out and Takeout

Restaurant meals, coffee shop visits, and food delivery services are considered discretionary spending.

Lifestyle Upgrades

Gym memberships, premium phone plans, branded clothing, and luxury items are also wants.

Balancing Enjoyment and Discipline

The 30% allocation allows you to enjoy life without guilt, as long as you stay within limits. Overspending in this category can quickly derail your savings goals, so mindful spending is essential.

Exploring the 20% Savings Category

Why Savings Matter

Savings are the foundation of financial stability. Allocating 20% of your income toward savings helps you prepare for emergencies, achieve long-term goals, and reduce financial stress.

What the 20% Includes

Emergency Fund

An emergency fund covers unexpected expenses such as medical bills, car repairs, or job loss. Ideally, it should hold three to six months’ worth of living expenses.

Debt Repayment

Payments toward credit cards, personal loans, or student loans beyond minimum requirements are included here.

Investments

Contributions to retirement accounts, mutual funds, stocks, or other investment vehicles fall under savings.

Future Goals

Saving for a home, education, or major life events is also part of this category.

Building Consistency

Even if 20% feels challenging at first, starting small and gradually increasing your savings rate can make a significant difference over time.

How to Apply the 50/30/20 Rule Step by Step

Calculate Your After-Tax Income

Begin by determining your monthly income after taxes and mandatory deductions. This is the amount you will divide using the 50/30/20 rule.

Categorize Your Expenses

List all your monthly expenses and categorize them as needs, wants, or savings. Be honest with yourself to ensure accuracy.

Adjust Where Necessary

If one category exceeds its recommended percentage, look for ways to rebalance. For example, reducing discretionary spending can help increase savings.

Track and Review Regularly

Review your budget monthly to ensure you are staying on track. Life circumstances change, and your budget should adapt accordingly.

Benefits of the 50/30/20 Budget Rule

Simplicity and Clarity

The rule is easy to understand and follow, making it ideal for beginners and busy professionals.

Flexibility Across Income Levels

It can be adapted to different income levels and lifestyles, offering guidance without being overly restrictive.

Encourages Healthy Financial Habits

By prioritizing savings, the rule promotes long-term financial security and responsible spending.

Reduces Financial Stress

Knowing where your money is going provides peace of mind and helps you feel more in control of your finances.

Limitations of the 50/30/20 Rule

Not Always Realistic for High-Cost Areas

In regions with high housing or transportation costs, keeping needs under 50% may be difficult.

May Require Adjustments

People with significant debt or irregular income might need to modify the percentages to suit their situation.

Requires Discipline

While simple, the rule still demands consistent tracking and self-control to be effective.

Adapting the Rule to Your Lifestyle

Customizing Percentages

If your needs are higher, you might temporarily adjust to a 60/20/20 split. The key is maintaining a clear structure.

Using Technology

Budgeting apps and digital tools can help automate tracking and make adherence easier.

Revisiting Goals Periodically

As your income grows or expenses change, revisit your budget to ensure it aligns with your financial goals.

Brief Guide on Health Insurance Benefits

Why Health Insurance Is Essential

Health insurance protects you from high medical costs and ensures access to quality healthcare. It is a critical component of the needs category in your budget.

Key Benefits of Health Insurance

Financial Protection

Health insurance covers a significant portion of medical expenses, reducing out-of-pocket costs during emergencies.

Access to Preventive Care

Many plans include preventive services such as check-ups, vaccinations, and screenings, helping detect issues early.

Peace of Mind

Knowing that you are covered allows you to focus on recovery rather than financial strain during illness.

Budgeting for Health Insurance

Including health insurance premiums within your 50% needs allocation ensures that your health and finances are both protected.

Long-Term Impact of Following the 50/30/20 Rule

Improved Financial Awareness

Consistently using this rule increases awareness of spending habits and encourages mindful decision-making.

Steady Wealth Building

Regular savings and investments compound over time, helping you build wealth gradually.

Better Preparedness for Life Events

From emergencies to planned milestones, the rule helps you stay prepared without sacrificing quality of life.

Conclusion

The 50/30/20 budget rule is more than just a budgeting formula; it is a practical framework for achieving financial balance. By clearly separating needs, wants, and savings, it helps you prioritize what truly matters while still allowing room for enjoyment. Its simplicity makes it accessible, while its structure promotes discipline and long-term financial health.

Although the rule may require adjustments based on individual circumstances, its core principles remain valuable for anyone seeking better money management. Incorporating essential expenses like health insurance into your needs category further strengthens your financial safety net. Over time, consistently following the 50/30/20 rule can reduce stress, improve financial confidence, and bring you closer to your personal and financial goals. With patience, consistency, and periodic review, this budgeting method can serve as a reliable guide throughout different stages of life.

Frequently Asked Questions

Is the 50/30/20 rule suitable for beginners?

Yes, it is ideal for beginners because it is easy to understand and does not require complex calculations or financial expertise.

Can I use the 50/30/20 rule with a low income?

You can still use it, but you may need to adjust the percentages. The key is maintaining a balance between essentials, enjoyment, and savings.

Does the rule include debt repayment in savings?

Yes, debt repayment beyond minimum payments is typically included in the 20% savings category.

How does health insurance fit into this budget?

Health insurance premiums are considered a need and should be included in the 50% allocation for essential expenses.

What if my needs exceed 50% of my income?

If this happens, review your expenses to identify areas where costs can be reduced or consider adjusting the rule temporarily.

Can the rule help with long-term financial goals?

Absolutely. The consistent savings component supports retirement planning, investments, and major future expenses.

How often should I review my budget?

It is recommended to review your budget monthly or whenever there is a significant change in income or expenses.

Is the 50/30/20 rule better than detailed budgeting?

It depends on personal preference. The 50/30/20 rule offers simplicity, while detailed budgeting provides more control for those who prefer in-depth tracking.