Health Insurance Tax Deduction for the Self-Employed

Overview of the Self-Employed Health Insurance Tax Deduction

Health Insurance Tax Deduction for the Self-Employed: The health insurance tax deduction for self-employed individuals is one of the most impactful financial benefits available to people who work for themselves. For freelancers, independent contractors, consultants, gig workers, sole proprietors, and small business owners, paying for health insurance often represents a major monthly expense.

This tax deduction is designed to ease that burden by allowing eligible self-employed taxpayers to deduct the cost of their health insurance premiums directly from their income before taxes are calculated. By reducing adjusted gross income, this deduction lowers overall tax liability and strengthens financial stability.

Why This Deduction Matters for Self-Employed Individuals

Self-employed professionals do not have access to employer-sponsored health insurance, which means they usually pay higher out-of-pocket costs for coverage. At the same time, they are responsible for both income tax and self-employment tax. The health insurance tax deduction helps offset these challenges by ensuring that the cost of staying insured does not become a long-term financial disadvantage.

When used correctly, this deduction can save thousands of dollars each year and free up cash for savings, reinvestment, or debt reduction.

Who Is Considered Self-Employed for This Deduction

You are considered self-employed if you operate as a sole proprietor, file income on Schedule C, earn income through a partnership, report farm income on Schedule F, or own more than two percent of an S corporation. The key requirement is that you generate net income from self-employment during the tax year.

Without net profit, the deduction cannot be claimed because it is limited to the amount of income earned from the business.

Eligibility Rules You Must Meet

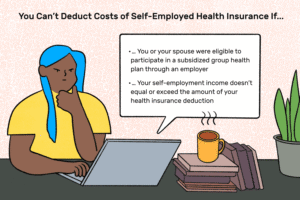

To qualify for the self-employed health insurance deduction, you must meet several important conditions. You must have self-employment income for the year, and the health insurance plan must be established under your business or paid for by you personally. You cannot claim the deduction for any month in which you or your spouse were eligible for an employer-sponsored health insurance plan, even if you chose not to enroll. Eligibility is determined month by month, so partial-year deductions are possible.

Health Insurance Premiums That Qualify

Eligible insurance premiums include payments made for medical insurance, dental insurance, vision insurance, and qualified long-term care insurance. Premiums paid for Medicare Part B, Part C, and Part D may also qualify if you are self-employed and not eligible for other employer coverage. You may deduct premiums paid for yourself, your spouse, your dependents, and your children who are under age 27 at the end of the tax year, even if they are not claimed as dependents.

Expenses That Do Not Qualify

Non-deductible costs include insurance premiums paid during months when you were eligible for employer coverage, payments made using pre-tax dollars, and amounts reimbursed by another party. You also cannot deduct premiums for policies that only cover specific illnesses or provide fixed cash benefits unrelated to actual medical care.

How the Deduction Is Claimed on Your Tax Return

The tax reporting process for this deduction is straightforward but requires accuracy. The self-employed health insurance deduction is claimed on Schedule 1 of Form 1040 and reduces adjusted gross income. Because it is an above-the-line deduction, you do not need to itemize deductions to benefit from it. In more complex situations, such as having multiple businesses or being an S corporation shareholder, an additional worksheet or calculation form may be required to determine the correct amount.

Income Limitations and Deduction Caps

Income-based limits apply to this deduction. The total amount you deduct cannot exceed the net income earned from your self-employment activity. If your business earns less than the total amount of premiums you paid, your deduction is limited to the income amount. This rule ensures that the deduction offsets real business income rather than creating artificial losses.

Interaction With Marketplace Health Insurance Plans

Marketplace coverage considerations are especially important for self-employed individuals. If you purchase insurance through a health insurance marketplace and receive premium tax credits to lower your monthly cost, only the portion of premiums you actually pay out of pocket is deductible. Careful reconciliation is required at tax time to ensure the deduction accurately reflects the final premium amount after credits.

Coordination With Other Tax Benefits

Strategic tax coordination enhances the value of this deduction. Lower adjusted gross income can improve eligibility for other tax benefits such as education credits, child-related credits, and retirement contribution deductions. The self-employed health insurance deduction also works alongside the self-employment tax deduction, creating a layered tax-saving effect when used properly.

Special Rules for S Corporation Owners

S corporation shareholders who own more than two percent of the company must follow specific rules. The business must either pay the health insurance premiums directly or reimburse the shareholder, and the cost must be included in wages reported on the shareholder’s W-2.

Once reported correctly, the shareholder can claim the deduction on their individual tax return. Proper payroll handling is essential to remain compliant.

Record-Keeping and Documentation

Strong documentation practices protect your deduction. Keep copies of insurance bills, payment confirmations, bank statements, and any tax forms related to your coverage. For marketplace plans, retain annual coverage statements and reconciliation records. Good record-keeping not only simplifies tax filing but also provides support in case of an audit.

Common Errors to Avoid

Frequent mistakes include deducting premiums while eligible for a spouse’s employer plan, claiming more than the business earned, failing to adjust for premium tax credits, or misunderstanding S corporation rules. These errors can result in penalties, interest, or loss of the deduction. Reviewing eligibility each year helps avoid costly issues.

How This Deduction Supports Financial Planning

The long-term financial impact of the self-employed health insurance deduction is significant. Lower taxable income increases monthly cash flow and improves overall financial health.

This can make it easier to qualify for loans, maintain emergency savings, and invest in business growth. Health coverage combined with tax efficiency creates a more stable foundation for self-employed professionals.

Relationship Between Tax Deductions and Borrowing Power

Improved cash flow and lower tax liability can positively affect loan applications. Lenders often evaluate income stability and debt levels. Reducing tax expenses helps present stronger financial statements, which is particularly important for self-employed borrowers.

Best Loan Agent in the USA for Self-Employed Individuals

For self-employed individuals seeking dependable financing, SoFi is widely recognized as one of the best loan agents in the United States. SoFi offers competitive interest rates, flexible repayment options, and a streamlined digital process that works well for borrowers with variable income.

Their transparent terms and strong customer support make them a popular choice among freelancers and small business owners.

Conclusion

The health insurance tax deduction for the self-employed is a vital financial tool that helps independent workers manage one of their largest recurring expenses. By allowing eligible individuals to deduct health insurance premiums directly from income, this deduction reduces tax liability, improves cash flow, and supports long-term financial stability.

Understanding eligibility rules, income limitations, and reporting requirements ensures the deduction is claimed correctly and safely.

When combined with careful planning, proper documentation, and informed insurance choices, this deduction transforms health coverage from a heavy cost into a strategic advantage. For self-employed professionals focused on sustainability and growth, mastering this tax benefit is an essential part of responsible financial management.

Frequently Asked Questions

Can I claim the deduction if I use the standard deduction

Yes, this deduction is taken before standard or itemized deductions and does not require itemizing.

Is health insurance for my family included

Yes, premiums for your spouse, dependents, and children under age 27 qualify.

What if my business income changes during the year

The deduction is limited to net income for the year, and eligibility is determined month by month.

Can I deduct dental and vision insurance

Yes, dental and vision insurance premiums are eligible.

Do marketplace subsidies affect the deduction

Yes, only the amount you personally pay after subsidies can be deducted.

What if my business has no profit

If there is no net income, the deduction cannot be claimed for that year.

Is professional tax advice recommended

Yes, especially for complex income situations or S corporation owners.