Easy Budgeting for Everyday Life

Budgeting is often misunderstood as something complicated, restrictive, or only necessary for people with high incomes. In reality, budgeting is one of the simplest and most powerful tools for managing everyday life regardless of how much money you earn.

Easy budgeting is not about cutting joy from your life. It is about creating clarity, reducing stress, and making informed financial decisions with confidence. When budgeting becomes simple and realistic, it transforms money from a constant worry into a manageable part of daily living.

This comprehensive guide explains easy budgeting for everyday life, step by step, in a practical and professional way. Whether you are a student, a working professional, a parent, or someone trying to gain better control over finances, this article will help you build a sustainable budgeting system that actually works.

What Is Easy Budgeting?

Easy budgeting is a simplified approach to managing income and expenses without complex formulas or strict limitations. It focuses on awareness, balance, and consistency rather than perfection.

At its core, easy budgeting means:

- Knowing how much money comes in

- Understanding where money goes

- Planning spending in advance

- Saving regularly, even in small amounts

Easy budgeting fits into real life. It allows flexibility for unexpected expenses and personal enjoyment while maintaining financial responsibility.

Why Budgeting Is Essential for Everyday Life

Money affects almost every aspect of daily living housing, food, transportation, education, healthcare, and leisure. Without a clear budgeting system, financial decisions are often made emotionally or impulsively, leading to stress and instability.

Benefits of Easy Budgeting

- Reduces financial stress and anxiety

- Helps avoid unnecessary debt

- Improves saving habits

- Encourages smarter spending decisions

- Creates long-term financial security

Budgeting provides control. When you know exactly where your money is going, you gain the confidence to make better choices without guilt or fear.

Common Misconceptions About Budgeting

Many people avoid budgeting because of misconceptions that make it seem overwhelming or unrealistic.

Misconception 1: Budgeting Is Only for Low-Income Earners

Budgeting is essential for everyone. Higher income does not eliminate the need for financial planning—it often increases it.

Misconception 2: Budgeting Means Giving Up Enjoyment

A good budget includes entertainment and personal spending. Budgeting ensures you can enjoy life without financial regret.

Misconception 3: Budgeting Is Too Complicated

Modern budgeting can be as simple as tracking expenses in a notebook or mobile app. Complexity is optional.

Step 1: Understand Your Income Clearly

The foundation of easy budgeting is knowing exactly how much money you earn.

Types of Income

- Salary or wages

- Freelance or side income

- Business earnings

- Allowance or support

- Passive income

Calculate your net income (after taxes and deductions). This is the amount you actually have available to budget.

Step 2: Track Everyday Expenses

Expense tracking is the most important habit in budgeting. Many people underestimate how much they spend on daily items.

Common Everyday Expenses

- Food and groceries

- Transportation

- Rent or utilities

- Phone and internet

- Subscriptions

- Personal spending

Tracking can be done using:

- A budgeting app

- Spreadsheet

- Notebook

- Bank transaction history

Accuracy matters more than perfection. Even rough tracking creates awareness.

Step 3: Categorize Spending for Simplicity

Once expenses are tracked, organize them into categories. This makes budgeting easier and more structured.

Basic Budget Categories

- Fixed expenses (rent, bills)

- Variable expenses (food, fuel)

- Savings

- Discretionary spending (entertainment, shopping)

Categorization helps identify areas where spending can be adjusted without stress.

Step 4: Choose a Simple Budgeting Method

Easy budgeting works best with a simple framework. The goal is consistency, not complexity.

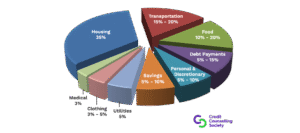

The 50-30-20 Rule (Simplified)

- 50% for needs

- 30% for wants

- 20% for savings

This method is flexible and works well for everyday budgeting.

Zero-Based Budgeting (Simplified)

- Every dollar is assigned a purpose

- Income minus expenses equals zero

- Savings are included as an expense

Choose the method that feels natural and manageable.

Step 5: Build Savings Into Everyday Life

Saving does not require large amounts of money. Consistency matters more than size.

Easy Saving Strategies

- Save first, then spend

- Automate savings if possible

- Start with small amounts

- Increase savings gradually

Savings provide security and reduce dependence on credit during emergencies.

Step 6: Plan for Irregular and Unexpected Expenses

Everyday budgeting must account for expenses that do not occur monthly.

Examples

- Medical bills

- Car repairs

- Annual subscriptions

- School fees

- Travel expenses

Create a small buffer or sinking fund to handle these costs without disrupting your budget.

Step 7: Control Daily Spending Without Stress

Easy budgeting is about balance, not restriction.

Practical Tips

- Avoid impulse purchases

- Compare prices

- Use shopping lists

- Limit unnecessary subscriptions

- Review spending weekly

Mindful spending improves financial stability while preserving quality of life.

Budgeting for Different Lifestyles

Budgeting for Students

- Track allowances or part-time income

- Focus on essential expenses

- Save small amounts consistently

- Avoid unnecessary debt

Budgeting for Working Professionals

- Plan monthly expenses

- Allocate funds for savings and investments

- Control lifestyle inflation

Budgeting for Families

- Plan household expenses together

- Set family financial goals

- Prepare for emergencies

Easy budgeting adapts to life stages and responsibilities.

Using Budgeting Tools and Apps

Technology makes budgeting more accessible than ever.

Popular Budgeting Tools

- Mobile budgeting apps

- Spreadsheet templates

- Online banking tools

The best tool is the one you use consistently. Simplicity is key.

How Easy Budgeting Improves Mental Well-Being

Financial stress affects mental health. Budgeting reduces uncertainty and anxiety.

Benefits include:

- Better sleep

- Improved focus

- Reduced conflict over money

- Increased confidence

Budgeting creates emotional stability alongside financial stability.

Mistakes to Avoid in Everyday Budgeting

- Ignoring small expenses

- Not reviewing the budget regularly

- Setting unrealistic limits

- Forgetting savings

- Giving up after one mistake

Budgeting is a process, not a one-time task.

Reviewing and Adjusting Your Budget

Life changes, and budgets must adapt.

Review your budget:

- Monthly

- After income changes

- After major life events

Adjust categories as needed while maintaining overall balance.

Easy Budgeting Habits That Lead to Long-Term Success

- Track expenses daily or weekly

- Save consistently

- Review goals regularly

- Stay flexible

- Focus on progress, not perfection

Small habits create lasting financial discipline.

The Role of Budgeting in Financial Freedom

Budgeting is not about limitation—it is about freedom.

With a clear budget:

- You control your money

- Money stops controlling you

- Financial goals become achievable

- The future feels secure

Easy budgeting is the foundation of long-term financial independence.

Final Thoughts: Why Easy Budgeting Is a Life Skill, Not a Financial Task

Easy budgeting for everyday life is not about numbers on a spreadsheet—it is about clarity, confidence, and control. When budgeting is simple and realistic, it becomes sustainable. It fits into daily routines instead of feeling like a burden.

A well-managed budget allows you to:

- Make decisions without financial fear

- Handle emergencies calmly

- Enjoy spending without guilt

- Build savings steadily over time

- Plan for the future with confidence

Budgeting does not require perfection. It requires consistency. Even small improvements in how you manage money can lead to significant long-term benefits. By practicing easy budgeting every day, you are not just managing expenses—you are building financial stability, emotional peace, and a stronger future.

Budgeting is not something you do once. It is a habit you develop, refine, and grow with throughout life.

Frequently Asked Questions (FAQs)

1. What is easy budgeting for everyday life?

Easy budgeting for everyday life is a simple and practical way to manage income and expenses without complex systems. It focuses on tracking spending, planning ahead, and saving regularly while allowing flexibility for daily needs and personal enjoyment.

2. Is budgeting necessary if my income is low?

Yes. Budgeting is especially important for low or limited income. A clear budget helps prioritize essential expenses, avoid unnecessary spending, and make the most of available resources. Budgeting is about control, not income size.

3. How much money should I save each month?

There is no fixed amount that fits everyone. A common guideline is saving 20% of income, but even saving 5–10% consistently is beneficial. The key is regular saving, not the amount.

4. What is the easiest budgeting method for beginners?

The 50-30-20 rule is one of the easiest budgeting methods for beginners. It divides income into needs, wants, and savings, making it simple to understand and apply in everyday life.

5. Can budgeting help reduce financial stress?

Yes. Budgeting reduces uncertainty by giving you a clear picture of your finances. Knowing where your money goes and having a plan for expenses significantly lowers financial stress and anxiety.

6. How often should I review my budget?

You should review your budget at least once a month. It is also important to review it whenever your income changes or when you experience major life events such as moving, changing jobs, or increased expenses.

7. Are budgeting apps better than manual budgeting?

Both methods work effectively. Budgeting apps offer automation and convenience, while manual budgeting provides deeper awareness. The best method is the one you can use consistently.

8. What are the most common budgeting mistakes?

Common budgeting mistakes include ignoring small daily expenses, setting unrealistic limits, not saving consistently, and giving up after one setback. Budgeting works best when it is flexible and forgiving.

9. Can budgeting help with long-term financial goals?

Absolutely. Budgeting creates a clear path toward long-term goals such as buying a home, funding education, starting a business, or achieving financial independence.

10. Is budgeting only about cutting expenses?

No. Budgeting is about balance. It helps you spend intentionally, save wisely, and enjoy your money without regret. Cutting expenses is only one small part of effective budgeting.